We have been getting a lot of inquiries from more current merchants to forex on what is value activity exchanging, and how one can use a forex value activity methodology.

What we are going to cover is the conventional meaning of value activity, how we approach it uniquely in contrast to other people, and how one can exchange value activity in the forex advertise.

What is Price Action Trading?

In the most customary and specialized sense, value activity is essentially value's development after some time. This could be on whenever pressure from the 1min up to the week by week outline. Any value variance for any instrument is a type of value activity.

Forex value activity exchanging is the science and craft of exchanging these value changes after some time with practically no pointers. By figuring out how to peruse value activity and value's development after some time, one can;

see where the institutional players are vigorously included

where they are driving the market

where are key help and opposition regions

where to discover exact passage and ways out

what is a key breakout

instructions to get inversions

tops and bottoms

get into patterns

what are hasty versus restorative moves

what sort of market condition you are in

This is the reason for figuring out how to peruse value activity can be a basic segment of one's exchanging.

Be that as it may, given one's way to deal with it, there are key contrasts by the way one can exchange it.

Different Ways to Approach Price Action

Generally, the entirety of the vanilla forex value activity exchanging strategies you discover there depend on designs. A portion of these examples can be banners, triangles, twofold tops and bottoms, pin bars, inside bars, and so forth. In any case, if you are exchanging these examples since they are an example, at that point you are truly neglecting to comprehend what value activity is.

The proximate driver of value activity is structure stream which is the complete summation of all purchase and sale arranges that are executed in the market. It doesn't make a difference whether the market is moving a direct result of a central or specialized explanation. Request stream is the most predictable power which causes the value activity to change.

Since we don't have direct access to arrange stream, we need to figure out how to peruse its kin which is value activity. Value activity has the fingerprints of request stream on top of it.

Since the most widely recognized driver of market developments originates from request stream, at that point we need to figure out how to peruse value activity. This is the way we approach it.

We exchange forex value activity procedures and examples, yet we do as such with the key understanding that all value activity is the aftereffect of request stream.

What's more, since request stream is the thing that moves the business sectors, at that point we need to figure out how to peruse request course through value activity. This how you can take your exchanging to the following level.

Exchanging Price Action

Value activity exchanging the forex showcase is a learnable expertise that anybody can do. With the correct preparing, tutor, and study, one can effectively use a value activity methodology.

In the forex advertise, as it is such an exceptionally fluid market, exchanging turns into significantly simpler because as you have greater liquidity, you have an all the more, in fact, unadulterated market. There are different approaches to exchange value activity in the forex market and we will share one strategy while clarifying the request stream behind it. We will contrast this with exchanging the example without anyone else and give you how it falls flat.

Exchanging Just the Pattern By Itself

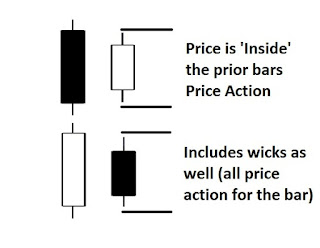

An inside bar design is a typical value activity design whereby the entirety of the value activity (body and wicks) of light is inside the scope of the past flame. Here is an image beneath indicating an inside bar design:

Presently inside bars can be exchanged as both inversion and pattern continuation systems. On the off chance that one was simply exchanging the example itself without understanding the request stream behind it, one could be truly deceived into exchanging a lesser inside bar essentially because it was an example. Because an example of arrangement shows up wouldn't mean we like to exchange it. We will give you a model.

Not Every Inside Bar Are Made Equivalent

Lets state it is 12hrs before a significant declaration, or a Friday, or an occasion of sorts. During such occasions, request stream lessens as the institutional players leave the market until the hazard occasions are finished.

During circumstances such as the present, numerous inside bars can shape since there is no one responsible for the market and no substantial liquidity or request streams. On the off chance that you were simply exchanging inside bars because an inside bar appeared, you could be exchanging during a non-ideal time because the market won't take a course till after the hazard occasion. So this is one case of how exchanging an example since it shows up could be destructive to your exchange.

This is the reason it is basic to comprehend the request stream behind the market and why the value activity is shaping how it is. Along these lines, you can figure out who is in charge (the purchasers or dealers). You can decide whether it is an incredible breakout or a bogus one. You can decide whether the pattern will probably proceed or not. These are basic to exchanging value activity and seeing how the request stream is making such factors.

The following is a diagram case of how not every single inside the bar are made equivalent and why you have to dodge some of them. Investigate the forex value activity exchanging graph underneath:

In this valued activity exchanging outline, you are seeing the value activity from 9am EST up to 1am EST (an aggregate of 18hrs). Investigate all within bars above. Here you have an aggregate of 3 inside bars, yet they created no uncommon response. The cost was stuck in a virtual 50pip territory for over an 18hr period.

On the off chance that you were simply exchanging inside bars since it was a value activity design, you would have had numerous bogus breakouts and likely many losing exchanges. Presently let us investigate another case of how an inside bar can be utilized for an effective exchange by perusing the request stream behind it.

Investigating the graph beneath, we can see inside bar shapes after an incredible pattern move. There could be a few explanations behind this however lets read the request stream behind it.

Cost has been moving for 4 days straight recommending the purchasers are unmistakably in charge.

The last flame was an exceptionally solid light and the biggest in this move proposing solid cooperation

Within bar comes directly at the equality level proposing the market is regarding it

Nonetheless, the selling in within bar is very powerless imparting the merchants have little influence

Along these lines, the purchasers are probably going to proceed with the pattern after this feeble push back

So enabled with this data on figuring out how to peruse the request stream behind the move and inside bar, we can settle on a substantially more educated choice on exchanging this inside bar. We can exchange this as a with-pattern continuation move realizing the purchasers are vigorously in charge. What's more, as should be obvious, the market moved for over 300pips throughout the following three candles.

In Synopsis

Forex value activity exchanging its most specialized structure is value's development after some time. This is for any instrument on whenever outline from tick diagrams up to month to month graphs.

All value activity is the aftereffect of request stream which is the complete summation of all purchasing and selling. All the value developments we see on the graph are subsidiaries of the request stream. At the end of the day, the request stream is the reason for all value development and its kin is value activity. Since we don't approach the total request stream in the forex showcase, figuring out how to peruse value activity and the request stream behind it is vital.

In exchanging the forex showcase, we can exchange value activity designs without anyone else, however, we can undoubtedly perceive how dis-engaging this is.

Examples independent from anyone else are good for nothing except if we can peruse the value activity and request stream behind it.

At the point when we can peruse the request stream, we can figure out where the institutional players are purchasing and selling, the speed of purchasing and selling, where are key help and obstruction regions, when the market will proceed with the pattern, when it will turn around and when key breakouts are going on.

These are basic to the forex value activity exchanging technique. Our objective must be to figure out how to peruse value activity and the request stream behind it.

For those of you need to figure out how to peruse value activity and the request stream behind it, investigate our Propelled Value Activity Course where you will learn rule-based value activity frameworks to exchange the forex showcase.

The Complete Run Down Of Price Action Trading(Price Action Trading Explained 2019)

Reviewed by zeal

on

7:50:00 PM

Rating:

Reviewed by zeal

on

7:50:00 PM

Rating:

Reviewed by zeal

on

7:50:00 PM

Rating:

Reviewed by zeal

on

7:50:00 PM

Rating:

No comments: